Table of Contents

Fitch Ratings Scale

Fitch Ratings Inc. in an international credit rating agency.

Together with Moody's and Standard & Poors, Fitch is one of the largest credit rating agencies in the world.

Fitch Rating was founded in 1913.

Credit rating agencies make risk assessments of financial instruments like:

- Government bonds

- Big corporations bonds

- Preferred stocks

- Mortgage backed instruments

Scale

Credit Ratings give an asessment to financial instruments. For example, an “investment grade” asset can have the following ratings:

- AAA The highest rating.

- AA

- A

- BBB

Fitch uses the symbols + and - to make smaller adjustment to it's ratings. For example, AA+ is better than AA.

A credit rating is an assessment of the financial capacity of an entity (corporation or government institution) to pay it's financial obligations. Common stocks do not constitute debt: they are not subject of credit ratings. Credit ratings apply to debt securities like bonds.

Credit ratings can be applied also to:

- Corporations

- National governments

- Financial institutions

- Insurance companies

- Municipalities

It is considered that an institution with a better rating (AAA) has a lower default risk than an institution with a worse rating (BBB).

Fitch Rating Scale:

Investment Grade:

- AAA: the best grade. This grade is given to stable and reliable companies. As of 2018, in US only Microsoft and Johnson & Johnson are rated AAA

- AA: these are quality companies that have very strong capacity to meet it's financial obligations but a little more riskier that AA companies.

- A: Strong capacity to meet it's obligations. This capacity may be more vulnerable to changes in economic conditions.

- BBB: these are medium class companies. There is a low expectation of interrupted payments, but changes in circumstances are more likely to impact it's capacity.

Non-investment grade The probability that the company will repay it's debt is deemed to be speculative.

- BB: company's payment capacity is prone to changes in the economy.

- B: the financial situation of the company varies noticeably.

- CCC: the current situation of the company is vulnerable. The company depends on favorable conditions to meet it's commitments.

- CC: very vulnerable

- C: the company or issuer can be in bankrupcy, but it's still paying it's obligations.

- D: the company has defaulted, and Fitch believes it will default most of the future obligations.

- NR; Not Rated

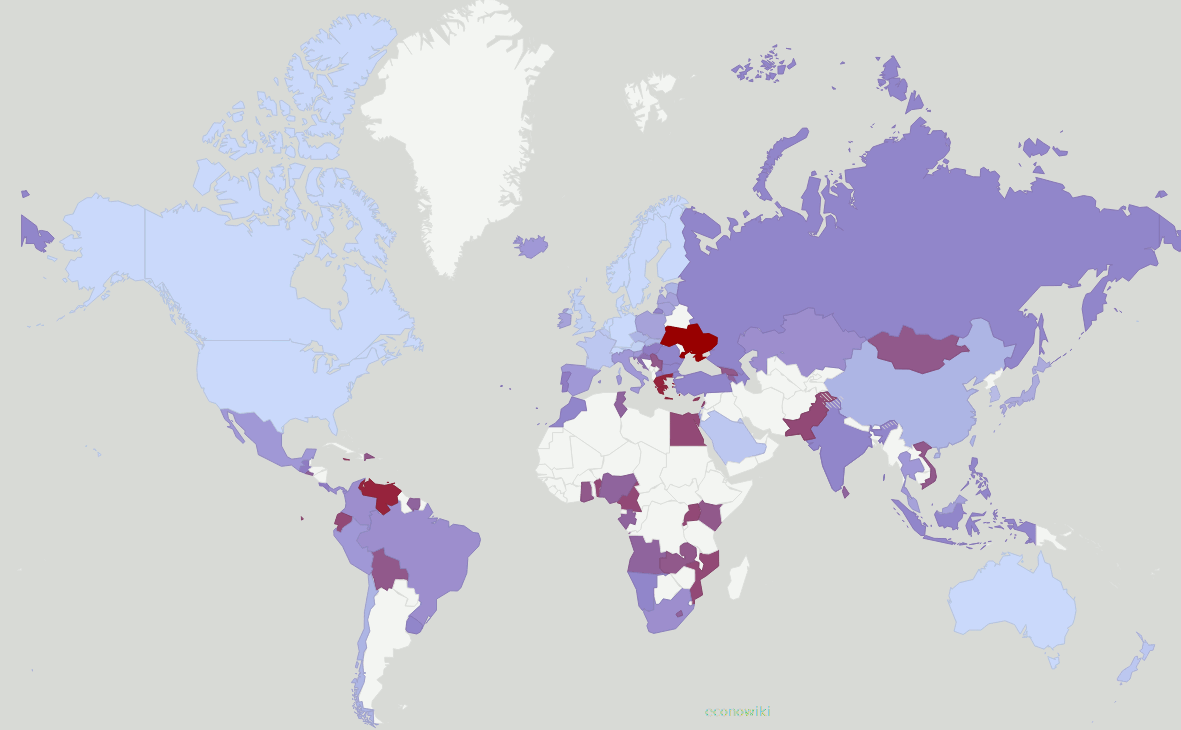

Fitch ratings for selected countries:

- Light blue represent countries with good ratings

- Violet represents countries with ratings near to BBB

- Red represents countries with bad credit ratings (CCC)